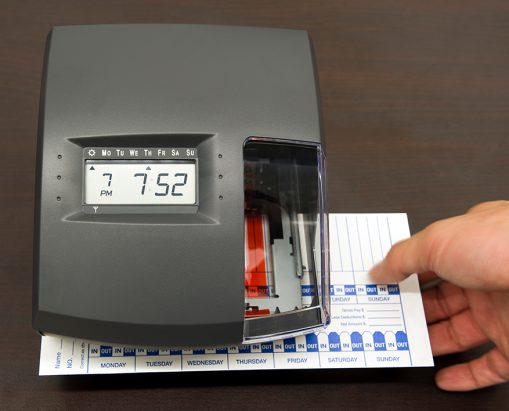

A rounding policy is a practice by which employers “round” up or down an employee start and end time, often to the nearest quarter-hour, to more easily calculate the number of hours worked for payroll purposes. Although not without risk because of potential pitfalls in implementation, the use of a rounding policy has not been considered illegal as long as it was administered in a “neutral” fashion and implemented fairly so that it was not always to the employer’s benefit. Rounding policies have been accepted because of the practical and administrative difficulties in otherwise calculating the number of hours worked.

The continuing viability of rounding policies, however, is now in question. Last fall, a California appellate court decision, Camp v. Home Depot U.S.A., Inc., held that since Home Depot’s electronic time-keeping system allowed Home Depot to capture the exact amount of time employees worked during their shifts, Home Depot was required to pay the employees for all hours and minutes worked as calculated by its system, rejecting the application of Home Depot’s rounding policy. The California Supreme Court accepted a petition to review the case, and opening briefs are to be filed in May.

Given the fact that electronic time-keeping systems have resolved the practical and administrative difficulties related to calculating the number of hours and minutes worked, employers using such electronic systems should not use a rounding policy and should not round time. And all employers continuing to round time should carefully evaluate their policies and determine whether or not rounding is necessary and appropriate. While we cannot predict exactly what the California Supreme Court will decide, it is highly likely that the court will issue more restrictive guidelines related to rounding – if not an outright prohibition of rounding policies altogether.

Related practice team: Labor and Employment